WHAT’S A FICO SCORE?

A FICO SCORE IS A THREE-DIGIT NUMBER BASED ON INFORMATION THAT IS IN YOUR CREDIT REPORTS. THIS INFORMATION HELPS LENDERS TO DETERMINE HOW LIKELY YOU ARE TO REPAY A LOAN. THIS, IN TURN, AFFECTS HOW MUCH YOU CAN BORROW, HOW MANY MONTHS YOU HAVE TO REPAY, AND HOW MUCH IT WILL COST PARTICULARLY THE INTEREST RATE.

YOUR CREDIT SCORE AFFECTS

HOME MORTGAGE: YOUR CREDIT SCORE NOT ONLY AFFECTS THE MONTHLY MORTGAGE PAYMENTS; IT ALSO DETERMINES WHETHER YOU WILL BE APPROVED OR DENIED.

AUTO LOANS: A GOOD CREDIT SCORE WILL BE THE DIFFERENCE IN THE MONTHLY PAYMENTS THAT YOU CAN QUALIFY FOR.

RENTING AN APARTMENT: MOST APPLICATION(S) IF NOT ALL REQUIRES A COMPLETE BACKGROUND CHECK AND REQUIRES A CREDIT SCORE TO DETERMINE WHETHER OR NOT YOU CAN QUALIFY FOR AN APARTMENT.

EMPLOYMENT: MOST COMPANIES ARE NOW REQUIRING AND ARE INCLUDING A CREDIT CHECK AS PART OF THEIR EMPLOYMENT PRE-SCREENING PROCESS. KNOW WHERE YOU ARE.

CREDIT CARDS: YOUR CREDIT SCORE AND CREDIT HISTORY ARE SOME OF THE DETERMINATION FACTORS IN THE PROCESS OF APPROVING OR DENYING YOU FOR A CREDIT CARD. ALSO INTEREST RATES, CREDIT LIMIT AND THE TYPE OF CREDIT CARD.

INSURANCE: MOST INSURANCE PLANS, RATES, AND PREMIUMS CAN ALSO BE A FACTOR BASED ON THE CREDIT SCORE.

PERSONAL LOANS: MOST BANKS AND OR LENDING INSTITUTION WILL MAKE DECISIONS ON WHETHER YOU CAN QUALIFY FOR A LOAN, BASED ON YOUR CREDIT SCORE.

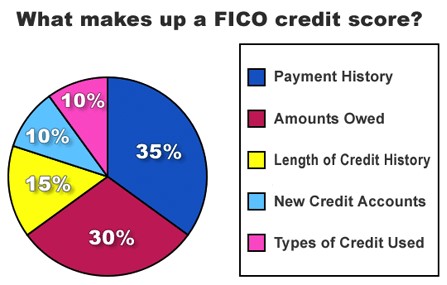

WHAT’S IN A FICO SCORE?

1) PAYMENT HISTORY WHICH MAKES UP 35% OF THE TOTAL CREDIT SCORE.

2) AMOUNT OF DEBT COUNTS FOR 30% BASED ON A BORROWER’S TOTAL OUTSTANDING DEBT, NAMELY REVOLVING LINES OF CREDIT.

3) LENGTH OF CREDIT HISTORY 15% THIS IS BASED ON THE AGE OF EACH ACCOUNT THAT IS OPENED.

4) NEW CREDIT COUNTS FOR 10% THIS AREA IS VERY FRAGILE, ONE SHOULD AVOID OPENING TOO MANY CREDIT LINES AT THE SAME TIME, SINCE THIS BEHAVIOR MAY BE LOOKED UPON AS BEING IN FINANCIAL TROUBLE.

5) MIX OF CREDIT COUNTS FOR 10 % THIS AREA IS QUITE VAGUE IN THE CATEGORIES, BUT MOST LENDERS LIKE TO SEE MULTIPLE VARIATIONS OF ACCOUNTS TO INCLUDE MORTGAGE, AUTO LOANS, CREDIT CARDS, AS THIS INDICATES TO THEM THAT YOU ARE LESS OF A RISK FACTOR.

DO YOU HAVE A BAD OR CHALLENGED CREDIT SCORE?

WE CAN HELP WITH THAT…

A FEW POINTS COULD MEAN THE DIFFERENCE BETWEEN APPROVED OR DENIED, AND WITH JUST ONE MISTAKE IT COULD DECREASE YOUR SCORE.

WHAT IS YOUR CREDIT COSTING YOU?

A FAIR CREDIT SCORE CAN COST YOU THOUSANDS OF DOLLARS IN INTEREST OVER THE TERMS OF A LOAN. AVERAGE LOAN AMOUNT: MORTGAGE LOAN AMOUNT: 253,435 WITH VERY GOOD CREDIT SCORE-740-799 WILL COST YOU $219,660 WITH FAIR CREDIT SCORE-580-669 WILL COST YOU $261,076 TOTAL INTEREST COST DIFFERENCE $41,416.

How Can I Improve My Score?

Schedule your Appointment!